The government is making a wide range of adjustments across the board for the coming year. Changes impactMedicare premiums, Social Security COLA, tax brackets, and retirement plan contribution limits. The changes could mean higher income and tax savings for some next year.

Medicare

Medicare Part B Premiums have decreased. The base monthly premium for Medicare Part B enrollees will now be $164.90 for 2023, a decrease of $5.20 from 2022. The annual deductible for all Medicare Part B beneficiaries is $226 in 2023, a decrease of $7.00.

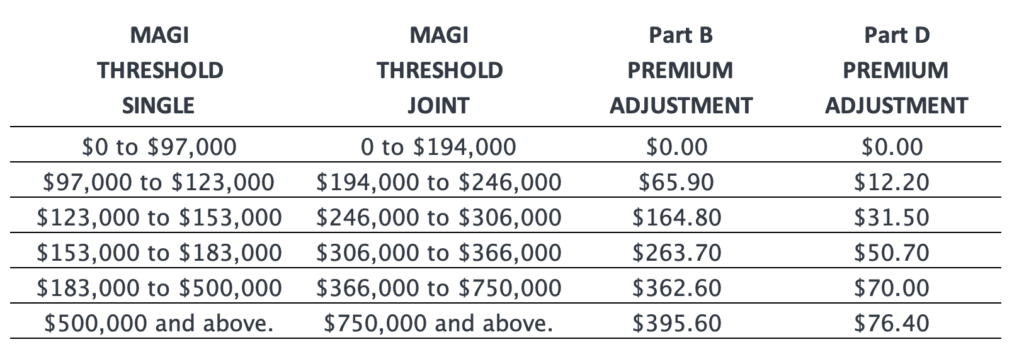

Medicare premiums are adjusted based on income, meaning higher income enrollees pay $164.90 for Part B and about $31.50 for Part D plus the adjustment. IRMAA Brackets and adjustments for 2023 are as follows:

You may also notice a new premium table that may or may not apply to you. Beginning in 2023, certain Medicare enrollees who are 36 months post kidney transplant, and therefore are no longer eligible for full Medicare coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For more information on this specifically, read on here.

The Medicare Part A has no premium to the extent you or your spouse qualify by having 40-quarters (10-years) of eligible work history. That said, there are deductibles and co-insurance amounts that increased from 2022.

In terms of coverage, a big win in 2023 is related to prescriptions. The cost of insulin will be capped at $35 for a 30-day supply, and most vaccines will be free. This includes the popular shingles vaccine. More changes are slated for 2024 and 2025 related to capping out-of-pocket costs entirely and limiting premium increases. While mostly good news, the max Part D deductible edged up slightly and is now $505/year compared to $480 in 2022.

Social Security

Approximately 70 million Americans will see an 8.7% cost of living adjustment to their Social Security benefit and SSI payments in 2023. “On average, Social Security benefits will increase by more than $140 per month starting in January,” says Jeff Nesbit, Deputy Commissioner for Communications at Social Security.

On the flip side, more workers’ income will be taxed to help pay into the Social Security and Medicare programs. The same 7.65% tax rate applies to W-2 employees (x2 for self-employed), but up to $160,200 of wage will be taxed vs a max of $147,000 in 2022.

Another factor to note is the income threshold applicable to those taking social security prior to reaching full retirement age (FRA). In 2023, earning more than $21,240/yr while taking social security “early” will result in $1 of benefits withheld for every $2 in earnings above the $21,240 limit.

Here is Social Security’s full fact sheet for all changes.

Inherited IRAs

The SECURE Act changed distribution rules related to inherited IRAs. Starting 2020, non-spouse beneficiaries would need to distribute inherited IRAs within 10-yrs. It was unclear whether the IRAs needed to be taken out evenly, as desired, or even as a single lump in year 10. The IRS has just recently provided clarity on the topic although more needs to be ironed out. If RMDs had never started by the original owner, there is flexibility for how the distribution occurs over the 10-yr period. But if they had started, it’s expected that distributions are taken according to an RMD table in years 1-9, and fully cleared out in year 10. If this wasn’t done in 2020 and 2021 due to confusion on the matter, there will be no penalty. But it’s expected to be understood in time for 2022. Use this handy calculator to help determine your RMD for 2022.

Income Tax Brackets

The favorable changes made via the Tax Cuts and Jobs Act are set to sunset after 2025. Until then we may not see any material changes apart from normal inflation adjustments to the brackets. See chart for updated brackets, no changes to the rates.

The standard deduction for single taxpayers in 2023 will rise by $900 to $13,850, and increase for married taxpayers filing joint returns by $1,800 to $27,700.

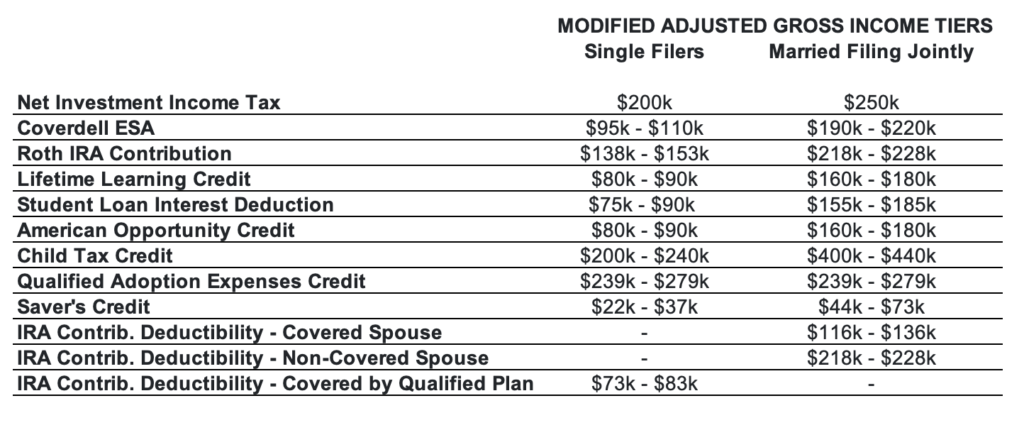

As it relates to the finer points of a tax return, ie – various deductions and credits, see the following chart. There has been no adjustment to the Net Investment Income Tax or the Child Tax Credit thresholds.

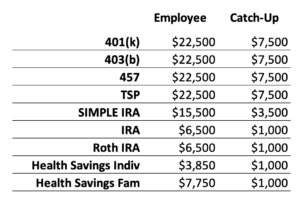

Retirement Plan Contribution Limits

IRS Release on Increased Limits.

What does this mean for you?

As you can see, there are many changes happening for 2023 that impact both workers and retirees. If you have questions or are unsure of the best approach to take, give us a call. We can help you determine which strategy might be the best and most appropriate for you. Set up a time to speak with the Wingate team today.