Your home has captured precious memories—holidays huddled by the fire, Sundays gathered around the table, and so on.

Whether it is a quaint mountain retreat or a sprawling estate, a clear estate plan will make the process of leaving property to heirs that much easier.

Here are some ways to go about this type of transition or event.

Talk With Your Family About Expectations and Interests

While your home may mean a great deal to you, your children may not have the same sentimental attachment.

For example, if all of your children live in California, do they want the 100-year-old estate on Cape Cod?]

It is also essential to consider if the property is a family home, a vacation home, a rental home, or a combination of these. Gain clarity by walking through some questions like:

- Do your children want to be landlords and split profits?

- Does one child want to buy out the others to live in the family house?

- Do they prefer you sell the property and simply split the proceeds?

You won’t know the answers to these questions unless you ask. As these situations and potential events become more of a future reality, it is critically important to set intentional time aside to have these types of conversations as a family.

Selling vs. Gifting The House To Your Kids

When it comes to the best strategy for passing on property, it entirely depends on your situation.

Selling

Selling the property to your heirs may make sense. If selling, make sure to sell at fair market value (FMV). If you don’t, the difference between the FMV and the sale price will be considered a gift. This “gift” would count towards your gift tax and lifetime exclusion for estate taxes.

Currently, the lifetime exclusion is set at $12.06 million ($24.12 million for married couples), but that number could change with a future tax or estate law change. In fact, it’s already set to reduce to $5 million (or $6.6 million if you factor in inflation) in 2026 unless new legislation passes.

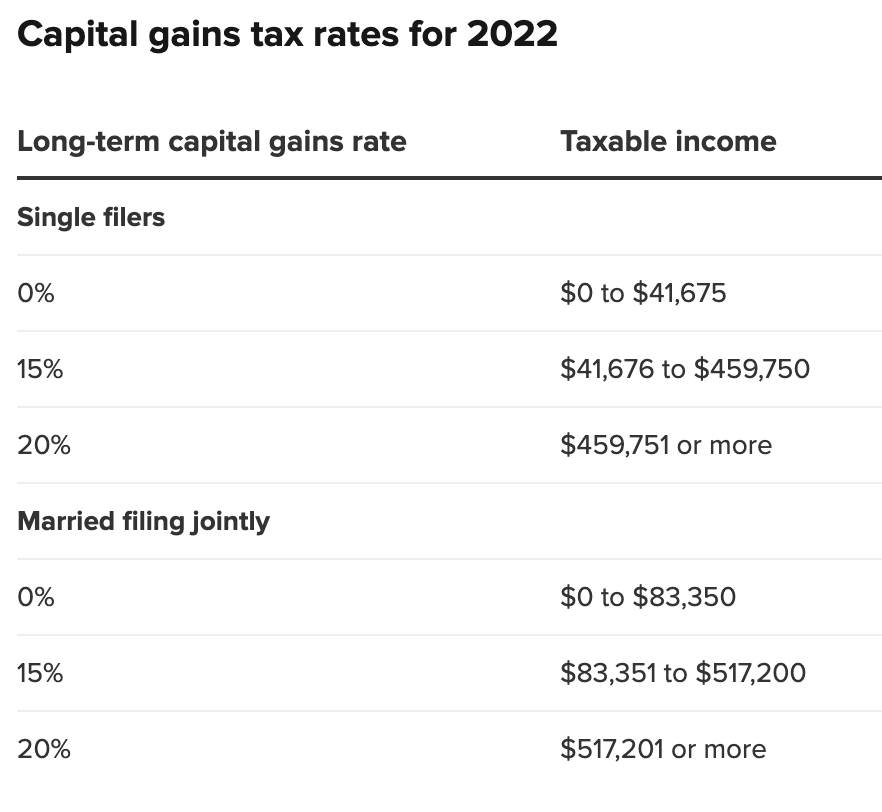

The potential issue with gifting is that it cuts into your lifetime exclusion and can have other tax consequences for heirs. Specifically, there would be no step-up in cost basis at the time of the donor’s death, so there could be a hefty capital gains tax bill at the time of eventual sale.

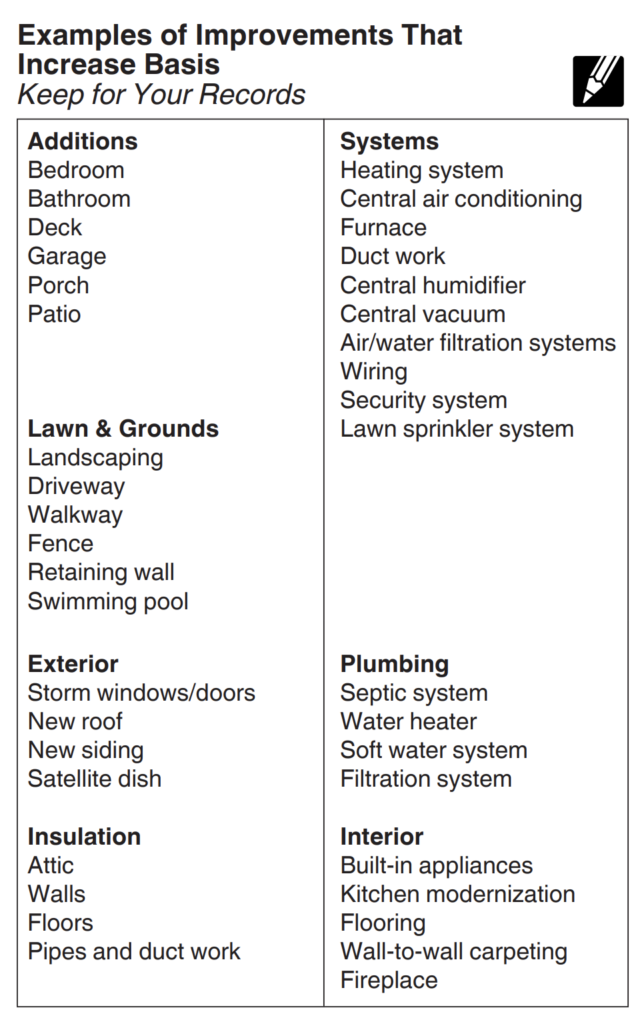

Pro Tip: One crucial and relevant note here is keeping track of any major renovations done on vacation properties. Keeping track of these project costs can be a massive help in decreasing capital gains taxes owed at the time of eventual sale.

Gifting

In some states, however, gifting may be a better option.

As you can see above, the annual exclusion is a very high number. Therefore, for most taxpayers, it would be a non-issue when it comes to federal gifting. However, you may need to consider a specific state estate tax in certain states.

For instance, in MA, the state estate tax triggers at $1 million, and it applies a tax on the entire net worth, not just what is over the $1 million figure. Therefore, gifting a home or property could actually remove a significant asset from the state estate tax. The same logic applies to other those with properties in states with high estate taxes.

Also, gifting the property will still be countable toward the trigger calculation but removes its value on the tax. An example and numbers may help clarify:

- If there is $900K in assets at death and the gifted property was $1 million, they add back the $1 million to trigger the MA estate tax but only assess tax on the $900K.

Finally, MA estate tax ranges from 0% to 16%, so gifting property to a Trust or outright needs to be weighed against the capital gains tax paid by the beneficiary since there would be no step-up in basis.

Since gifting can have complicated estate and income tax implications, you should consult your financial advisor, estate planning attorney, and accountant before making any decisions to gather valuable input from your team of professionals. By doing this, you will be able to make the best decision for your financial situation.

Employ A Qualified Personal Residence Trust (QPRT)

A QPRT is an irrevocable trust that enables you to remove your personal property from your estate.

Ultimately, it reduces taxes when transferring to heirs.

What is great about this vehicle is that the property owners can remain living in the home for a set period, and once that is up, the house transfers to the beneficiaries to remove both the current value and the property’s future appreciation from the grantor’s estate. Keep in mind that this type of trust is only beneficial if the grantor lives through the trust terms. If the donor dies before the end of the trust terms, the home is included in the donor’s taxable estate at whatever the full value of the home is at the time of the donor’s death.

Use A Revocable Living Trust

A revocable living trust is another excellent estate planning tool to consider if you want to pass down the property to heirs but retain control of the property while living.

With this type of trust, you can alter or change the terms as you see fit. You can set parameters over how the house is to be managed and when it should be sold. However, the property will still be considered a part of your estate.

It can also be helpful when dealing with property upkeep costs. For instance, you can have the trust pay the upkeep costs instead of having the children split the bill from their personal finances. If the goal was to keep the house in the family, having this nest egg can help to ensure it’s affordable for the next generation to keep.

Ultimately, this type of trust allows you to retain control of the property and leave a nest egg to take care of the property after you die.

Work With A Team

We can help make your personal property an intentional part of your financial (and estate) plan.

Whether you are considering making an outright gift or passing down a beloved piece of property, Wingate can help make intergenerational gifting a part of your comprehensive financial plan.

Our focus is to help clients see their complete picture and guide them in taking steps that optimize their long-term goals.

Wingate Wealth Advisors can analyze your case, make strategic recommendations, and help you execute the most effective strategies. If you’d like more information please contact us today.